Impact measurement

We expect a multi-trillion euro market potential for financial products that genuinely generate measurable social and environmental impact. Despite growing regulatory attention, markets still lack a credible, standardized methodology to assess investor contribution, creating risks of impact-washing and misallocation of capital. SFO's analysis and knowledge production since 2018 has shaped EU sustainable finance policy, and produced tools such as the Impact Potential Assessment Framework (IPAF), ISO 14097, Climate Impact Management System and guidance on environmental impact claims and client sustainability preferences. Widely trusted by policymakers and market actors, we are now scaling IPAF and building AI-enabled assessment and allocation tools which support integration of investor impact into EU regulation. Our goal is to help investors optimise portfolio impact and direct capital towards high-impact investments at scale.

The opportunity

We estimate a multi-trillion unmet demand for financial products that genuinely generate measurable positive social and environmental impact. This is driven by retail investors (high demand for impact-generating public market funds) and institutional investors (pensions, endowments or foundations with high demand for impact-generating public and private market funds). Against this backdrop, asset managers and regulators increasingly recognise the need to move beyond ESG risk management towards financing real-world outcomes. In parallel, several international regulatory initiatives - including the UK, Switzerland, Japan and now the EU - are developing regulation which integrates impact considerations into sustainable finance policies and practices.

The problem

Despite these efforts, there is still no prevailing methodology to assess the actual potential to achieve impact through financial products i.e. the change in the real world caused by the investment activities. The absence of a standardised framework to disclose this ‘investor contribution’ creates significant risks of impact-washing and misallocation of the multi-trillion euros managed under impact-oriented mandates. Without credible disclosure and evaluation mechanisms, market trust in impact finance remains fragile, its transformative potential underused and the risk of impact washing remains high. In our 2023 market review, 27% of all funds in scope were associated with environmental impact claims, but according to our assessment none of these environmental impact claims could be substantiated - indicating a substantial potential legal risk.

Our track record

Since 2018, we have produced cutting edge research, methodologies and policy recommendations to address the misallocation of impact-oriented investment:

- Integrating investor impact in the EU regulatory framework: Key recommendations of our policy briefing were integrated in the Commission’s legislative text for revision of the Sustainable Finance Disclosure Regulation. This represents a major success of our long work on the subject, including through contribution to expert groups such as the High Level Expert Group on Sustainable Finance, EU Eco Label working group and the Platform on Sustainable Finance.

- Mind The Gap: Why EU Retail Investors don’t get what they want: In this meta report, we provide the evidence for a significant unmet demand for impact-generating financial products based on our research on the demand, supply and distribution of impact-generating financial products over six years in 14 EU countries.

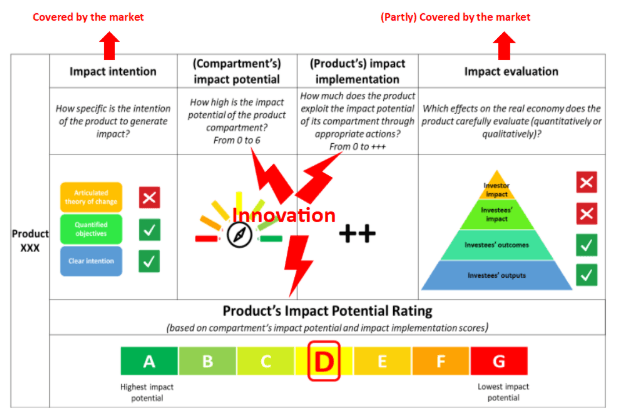

- The Impact Potential Assessment Framework (IPAF) for financial products: In the context of a three-year Horizon 2020 research project, we developed a new science-based framework to assess the impact potential of financial products. We successfully tested the IPAF on over 100 financial products, showing that the framework can be used to distinguish the impact potential among (different) financial products.

- ISO 14097 - A new standard for assessing and reporting green finance activities: We worked closely with French national standardisation body (AFNOR) to develop ISO 14097, a general framework for assessing, measuring, monitoring and reporting on investments and financing activities in relation to climate change and the low-carbon transition.

- Climate Impact Management System (CIMS): In the context of a multi-year EU-funded research program, we developed a series of tools for financial institutions for planning, managing and reporting on their climate impact performance.

- Guide on environmental impact claims for EU financial products: Together with a multistakeholder working group we developed this guide to fight impact-washing and to provide a clear framework for financial institutions to reduce legal, financial and reputational risks.

- Guidance and Questionnaire for assessing client sustainability preferences and motivations: Together with a multistakeholder working group, we developed a Guidance and Questionnaire to assist investment firms in carrying out a comprehensive assessment of client sustainability preferences and wider sustainability motivations (including impact objectives) and harmonise practices among investment firms.

The Sustainable Finance Observatory is a trusted source of insight for EU policymakers, supervisors, market participants and civil society – widely recognised for critical oversight of the retail sustainable finance ecosystem.

Our next phase

Our goal for the next five years is to enable investors to optimize the impact potential of their portfolios and steer capital towards higher impact investments at scale. Indeed, our IPAF proved that we can now distinguish the impact potential of financial products based on the impact mechanisms and actions they apply, which will be the basis to restructure impact-oriented investment portfolios in future.

To achieve our goal, we will:

- Provide scientific research together with leading researchers in the field of impact investing on the level of evidence of impact actions (including investor stewardship), AI based impact claim detection, a new Impact Asset Allocation Model and impact quantification methodologies.

- Develop the technological infrastructure together with our partners including an AI based IPAF rating tool to automatically assess the impact potential of financial products at large scale, an Impact Management System which will help financial institutions to assess, plan and report the impact potential of their financial products and an AI based asset allocation tools for professional and non-professional investors.

- Support the integration of investor impact in the revision of SFDR, MiFID/IDD, IORPs and SRD II, other policy instruments to leverage impact finance (e.g. tax incentives, guarantees) and the development of an EU Stewardship Code.

EU Project: Sustainable Finance 3.0 - A proposal for (re)orientation

Together with University Hamburg and Advanced Impact Research we will scale up IPAF ratings which can be used to measure and verify the impact potential of financial products. This will help to optimise impact-oriented investment portfolios which will increase capital flows towards financial products which effectively address the specific needs of social enterprises and impact firms (i.e. financing undersupplied markets, providing concessional capital and non-financial support).