Who we are

The Sustainable Finance Observatory is an independent international think tank specialised in mobilising private finance for the sustainable transition. Private capital represents 70 to 90% of the financing required to meet the objectives of the Paris Agreement and the Sustainable Development Goals. However, systemic barriers continue to prevent this vast potential from being fully unlocked.

Our mission is to remove barriers to private financing across the entire financial value chain, structured around three fundamental pillars: Transparency, Impact, and Bankable Sustainable Solutions.

This gives us a unique positioning that covers the full financial value chain, addressing both the supply side (financial institutions and financial products) and the demand side (the real economy).

How we work

An ecosystemic approach across the financing value chain

The Sustainable Finance Observatory operates across the entire financial value chain, working simultaneously on the supply side (financial institutions) and the demand side (the real economy).

Our work is grounded in robust financial expertise, supported by a multidisciplinary team of former bankers, sustainable finance analysts and lawyers, as well as by a Scientific and Expert Committee bringing together around fifty senior academics and practitioners. This specialised expertise enables us to deliver high-quality analysis and to develop bankable solutions with transformative impact.

We focus on developing methodologies, tools and financing solutions. Across all our programmes, we place strong emphasis on producing practical, directly usable outputs for stakeholders.

Our activities aim to drive changes in financial practices and develop financing solutions that support a sustainable, low-carbon economy. We adopt a pragmatic, solution-oriented approach, combining analysis, tools and methodologies to directly benefit public and private actors and generate real-world impact.

Our work spans a wide range of activities, including:

- analytical work and regulatory analysis;

- development of data, tools, and methodologies;

- provision of expertise and technical assistance;

- coordination and participation in multi-stakeholder coalitions; and

- contribution to public debate through advocacy.

Our work on Transparency and Impact is fully accessible and designed to benefit all stakeholders through open data and data-visualisation tools.

This positioning allows us to engage with the full ecosystem of sustainable finance actors: public and private financial institutions, public authorities, regulators and supervisors, national and sub-national governments, economic actors as beneficiaries of bankable sustainable solutions, as well as academia and civil society.

The Sustainable Finance Observatory is independent, pragmatic, science-based, solution- and innovation-oriented, and committed to developing collective intelligence in the general interest.

Transparency - Impact - Bankable Sustainable Solutions

Our three pillars of intervention ensure a unique positioning across the entire financial value chain - from the supply side of financial institutions to the demand side of the real economy:

- Transparency – monitoring financial institutions’ sustainability practices and commitments.

- Impact – assessing the real-economy outcomes of financial products.

- Bankable Sustainable Solutions – creating demand by developing bankability models aligned with financiers’ requirements.

Our history

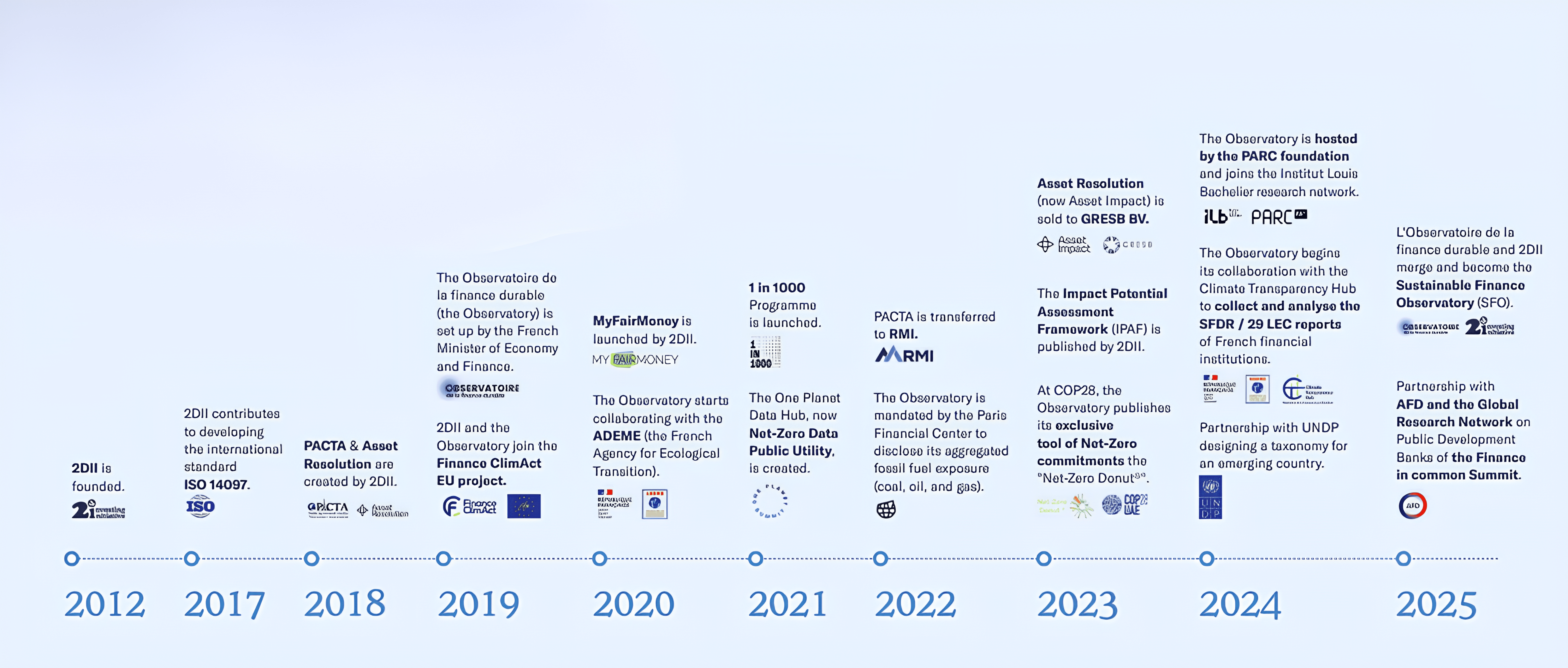

At the end of 2024, the French branch of the international think tank 2° Investing Initiative and the Observatoire de la finance durable officially joined forces to create a unified organisation focused on unlocking private finance for the sustainable transition.

Founded in 2012, 2° Investing Initiative has been a pioneering think tank supporting private financiers on climate alignment and impact investing.

The Observatoire de la finance durable was established by the French Minister of the Economy and Finance in 2019 to monitor ESG commitments and the alignment of the Paris Financial Centre with the objectives of the Paris Agreement.

This merger brought together two well-established organisations with complementary expertise, creating a stronger collective voice to advance sustainable finance practices and solutions globally.

Over the past 13 years, the Sustainable Finance Observatory has generated significant impact by fostering regulatory reforms and standards (including ISO standards, globally recognised climate-alignment methodologies, and national labels), improving transparency, strengthening financial practices, and supporting the reallocation of private investment towards sustainability through robust analysis, data collection, and ESG disclosure monitoring.

Discover our history through key dates: