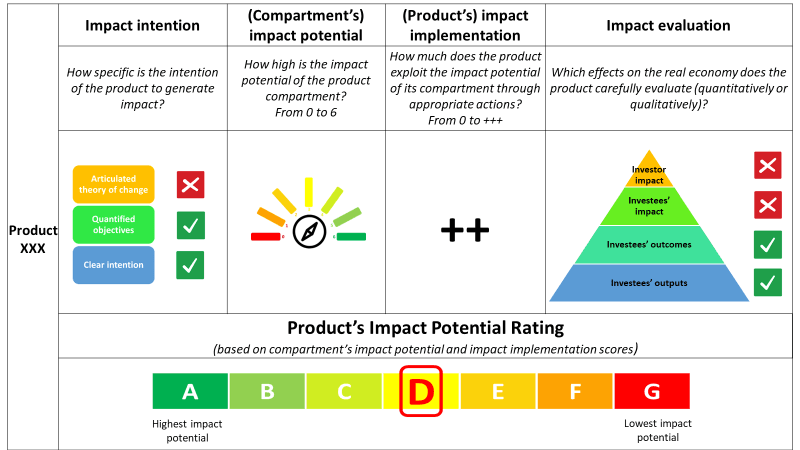

The project’s goal is to scale up impact potential ratings which can be used to measure and verify the impact potential of financial products. This will help to optimize impact-oriented investment portfolios which will increase capital flows towards financial products which effectively address the specific needs of social enterprises and impact firms (i.e. financing undersupplied markets, providing concessional capital and non-financial support).

Impact Investments: Reorienting Finance Towards Real-World Impact

Impact investing is growing rapidly, driven by investors who want their capital to contribute to positive social and environmental change and now introduced by the upcoming SFDR 2.0. Yet today, there is a fundamental gap between impact intentions and real-world impact. While many financial products claim to deliver impact, investors often lack reliable information on whether their investments actually make a difference beyond what would have happened anyway.

Our project, “Impact Investments: a proposal for (re)orientation” (SF3.0), addresses this challenge by developing a new way to understand, measure, and scale real impact in finance.

Why the project matters

Most existing sustainability and impact frameworks focus on the impact of companies or projects (for example, whether a company is environmentally friendly). However, they rarely assess whether a financial product itself contributes to change — for instance by providing capital where markets fail, supporting underserved social enterprises, or enabling long-term, higher-risk innovation.

As a result:

- Investors cannot identify genuinely impact-generating products,

- Capital is systematically misallocated,

- And misleading impact claims (“impact washing”) remain widespread.

At the same time, the demand for impact-generating financial products is untapped and regulators in Europe, the UK and Switzerland are calling for greater clarity on investor contribution and real-world impact. Against this backdrop, markets urgently need practical, credible tools to respond.

for public market funds

of reallocation towards EU asset managers

for private market funds

>610bn

Potential of EUR

for public market funds

What we do

The project develops and scales a science-based standard and rating system that assesses the impact potential of financial products — that is, their ability to generate real-world impact through investor actions.

Building on academic research and extensive market testing, we will build on the Impact Potential Assessment Framework (IPAF) which was developed and tested by SFO in the context of previous EU research projects.

SFO proved that the IPAF can be used to capture how investors can actively contribute to social and environmental outcomes and to distinguish the impact potential among various financial products — beyond simply investing in “good” companies.

From research to real-world use

The project combines:

- Academic research and open standards, ensuring scientific credibility and transparency;

- Stakeholder engagement, involving investors, asset managers, distributors, regulators and civil society;

- Technology and AI, enabling scalable, cost-efficient assessments through automated data collection and analysis.

The result is a set of practical services, including:

- Impact potential ratings for financial products,

- Benchmarking across products and asset classes,

- Clear, decision-useful reporting for investors and institutions.

Who benefits

The project supports:

- Investors seeking credible ways to align capital with real-world impact,

- Asset managers and product providers aiming to demonstrate genuine impact,

- Distributors and advisors responding to sustainability and impact preferences,

- Regulators and supervisors addressing impact washing risks,

- And ultimately impact enterprises, real estate, infrastructure and underserved markets that depend on effective impact finance.

Our ambition

Our long-term goal is to help shift sustainable finance towards “Sustainable Finance 3.0” — where impact is not only claimed, but demonstrated, verified, and scaled. By improving transparency and directing capital where it can do more good, the project aims to strengthen trust in impact investing and accelerate positive change in the real economy.